Welcome to daytradingforex.com. This website will help you become a successful day trader by helping you find a good reliable broker and by teaching you how to find and evaluate different trading strategies.

What is day trading?

The term day trading refers to short term trading on different financial markets. A day trader does not invest long term but rather move in and out of the market during the same day. It is common for a day trader to buy and then sell the same asset again within a few minutes of purchasing it. The goal is to make money from the volatility (fluctuating value) that all assets are subject to every single day. Most assets will change in value from one minute to the next. Day traders try to make money from these small fluctuations in the market.

What is FOREX?

The FOREX market, or Foreign Exchange Market, is the largest market in the world. The currency exchange market is a market where currencies are bought and sold. Let’s say that you have USD and need to exchange them for Euro. This is a foreign exchange transaction. You are selling USD and buying Euro. When you exchange money, then the bank or changer will be counterpart in the transactions. When you buy or sell currency on the FOREX market you will not know who the buyer is as millions of people and companies buy and sell currency each day.

Currency worth more than a trillion is traded every single day.

Why is the FOREX market suitable for day trading?

The FOREX market is very suitable for day trading. The market is extremely liquid which makes it easy to move in and out of the market when you want to. You never risk being stuck with a position that you are unable to sell. This is very important when trading with leveraged financial instruments. Where any delay to complete a transaction can cost a lot of money.

The FOREX market also offers a lot of small fluctuations while large rapid swings are rare. It is rare for a currency to move more than a tenth of a percentage point in a day and it is extremely rare that currencies move more than a percent in a day. It does happen, but only seldom. This makes the FOREX market more low risk than the stock market. Stocks can often gain or lose more than one percent in a single market session, and it is not rare for a stock to drop 10% in a single day due to unexpected bad news. These large swings in the stock market are opportunities to make a lot of money, but they might also cost you a lot of money.

The FOREX market is easier to predict using technical analysis than other markets. The value of a stock can fluctuate greatly due to nonfundamental factors such as hype or a rumor of a merger. This is a lot less true for currencies. They are therefore easier to predict.

How to invest in the FOREX market?

It is not practical to buy and sell actual currencies when trading on the currency market. Physical money (bills) are impossible to transfer efficiently. It is easy to transfer digital money kept in currency accounts but you will need to be able to trade substantial sums of money to be able to make a decent profit as a day trader.

A better option is to trade different financial instruments that are based on currency pairs. Their value is determined by the underlying currency pair and it is possible to trade leveraged instruments that allows you to make a decent profit without having to invest a lot of money. Leveraged FOREX instruments can have very large leverage which allows you to make or lose a lot of money on very small fluctuations in the market value of the underlying currency pairs. Some leveraged instruments offer leverage of x500. If the currency pair increase in value by 0.1% you will earn 50% on your investment.

Leveraged trades are sometimes referred to as margin trades.

Popular financial instruments

CFD Certificates

CFD, Contract for Difference, is a good way to day trade in the FOREX market. CFD:s are designed for day trading and make it very easy to assume leveraged short term positions on the currency market. There are a large number of different CFD brokers on the market and you can find one that provides the opportunities that you are looking for. You can read more about CFD:s here.

Binary Options

Binary options are a type of financial instrument that allows you to “bet” on the financial market. They are called binary options because they offer a binary outcome. You either earn a large predefined profit or you lose your entire investment. Binary options are sold by brokers who also act as underwriters. They profit when you lose money and the options are designed to cost you money. You need to be a skilled trader to make money trading these options since they always favour the broker. Binary options are banned within the EU but are still legal on many other markets. Click the link to see where binary options are legal.

I do not recommend binary options trading. It is too hard to make money. A large percentage of all traders lose money. You can read more about binary options here.

Core Strategies for Forex Day Trading

Successful forex day trading hinges on using effective strategies tailored to capturing profits from short-term price movements. The market offers a multitude of opportunities, but adopting a structured approach, instead of jumping on every opportunity you spot and flying by the seat of your pants, will increase your chances of attaining long-term success. You can learn more about core strategies for Forex Day Trading by visiting DayTrading.com. A website featuring a lot of info about Forex and Day Trading.

Below, we will take a look at some examples of strategies commonly used by day traders to navigate the fast-paced world of forex trading.

Examples of Trading Techniques

Scalping

Scalping is one of the most popular strategies for day traders who thrive on quick trades. It involves targeting small price changes and making multiple trades throughout the day to accumulate profits. The goal is not to capture significant market moves but to exploit small fluctuations in highly liquid currency pairs like EUR/USD or USD/JPY.

The difference between buy price and sell price will be tiny, so doing a large number of trades, or opening big positions, will be required to make a significant amount of money from scalping.

If you decide to do scalping, it is important that you pick a broker and trading account where the fee structure is suitable for scalping. If you do a multitude of small trades, make sure that the tiny profit from each trade is not eradicated by commissions and spreads.

It is also important that orders are executed really quickly, as scalping rely on small price changes and a profitable trade can turn into a loss if the order is not executed fast enough.

When it comes to predicting market movements, scalpers often rely on short time frames, such as one-minute or five-minute charts, and use technical indicators like moving averages or Bollinger Bands to identify entry and exit points. To succeed, scalping requires razor-sharp focus, lightning-fast execution, and a broker that offers tight spreads and fast order processing.

Trend Trading

Trend trading focuses on identifying and riding the market’s prevailing direction. Whether the market is in an uptrend, downtrend, or sideways trend, this strategy allows traders to align their positions with the larger movement.

Trend traders typically use indicators like moving averages, the Average Directional Index (ADX), or trendlines to confirm the direction and strength of the trend. If the market shows higher highs and higher lows, it indicates an uptrend, while lower highs and lower lows signal a downtrend.

Patience is a key trait for trend traders, as they often hold positions for longer within the trading day, waiting for the trend to mature before taking profits.

Trend-following is also carried out by traders that are not day traders, e.g. swing traders and position traders.

Range Trading

Range trading is a technical analysis-based strategy that focuses on markets moving within a defined support and resistance range. This approach is ideal when there is no strong directional trend (up or down).

For example, a currency pair might repeatedly bounce between a support level (where prices tend to stop falling) and a resistance level (where prices tend to stop rising). Traders can take advantage of this by buying at support and selling at resistance.

Indicators like the Relative Strength Index (RSI) and Stochastic Oscillator are commonly used to identify overbought and oversold conditions within a range. A disciplined approach is crucial here, as range breakouts can occur.

It is a good idea to learn how to spot the warning signs that can appear before the price breaks through a support or resistance level.

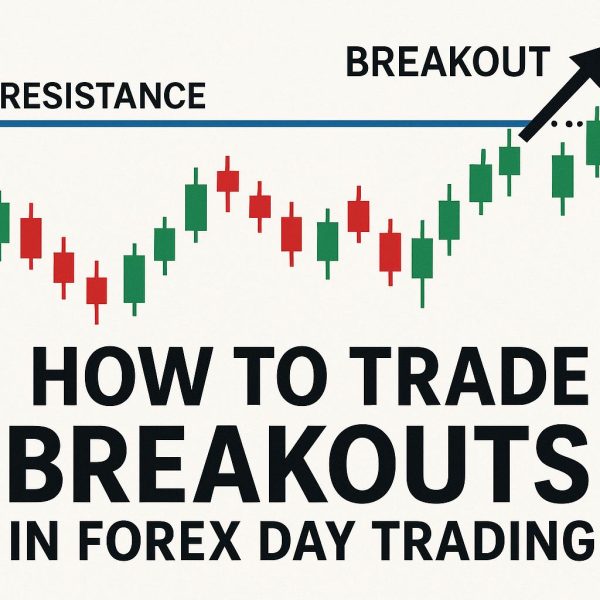

Breakout Trading

Breakout trading targets price movements that occur when an asset breaks through a key level of support or resistance. These breakouts often indicate the start of a new trend or increased volatility, presenting opportunities for significant profits.

For instance, when a currency pair breaks above a well-defined resistance level, traders may enter a long position, anticipating that the upward momentum will continue. Conversely, a break below support signals a potential short opportunity.

Breakout traders often use volume indicators to confirm the strength of the breakout and ensure it’s not a false move. Setting stop-loss orders just outside the breakout level helps manage risk if the trade doesn’t go as expected.

Choosing the Right Trading Strategy For Your Day Trading

Each of the common day trading strategies has its strengths and weaknesses, and no single approach works in all market conditions and trading accounts. Your personal skills, abilities, and preferences are also important to take into account.

Scalping is well-suited to fast-paced markets but requires intense focus and quick decision-making. Trend trading works best in directional markets but may result in fewer opportunities during consolidation phases. Range trading is effective in stable markets but can lead to losses during breakouts. Breakout trading offers high potential rewards during periods of increased volatility but comes with the risk of false breakouts.

The best strategy for you depends on a variety of factors, including your risk tolerance and the time you can dedicate to trading. You can practice each approach using play-money in a free demo account to find the one that aligns with your strengths and goals.

As you proceed, refining your chosen strategy and adapting it to changing market conditions can help you achieve consistency and success in forex day trading.

Using Technical and Fundamental Analysis in Forex Day Trading

Trading requires a combination of skills to predict the market successfully, and two essential methods to this end are technical analysis and fundamental analysis.

Technical analysis focuses on spotting trends and patterns in charts that display historic market price data, while fundamental analysis evaluates underlying factors that may have an impact on the market price. In the case of forex trading, fundamental analysis will typically have a strong emphasis on economic and political factors, e.g. central bank interest rate changes and changes in commodity prices.

Each method provides unique insights, and mastering both can help traders make well-informed decisions.

Technical Analysis

Technical analysis is the backbone of day trading, as it helps traders predict future price movements by studying historical price data, looking for trends and chart patterns. This approach typically relies on tools and indicators that help highlight trends, reversals, and areas of potential support and resistance. Technical analysis can also involve relying on price action alone to make decisions, avoiding the clutter of indicators.

Patterns

Day traders use chart patterns such as head and shoulders, double tops/bottoms, and flags to identify market behaviour and potential price direction. For instance, a flag pattern may indicate a continuation of the trend, while a double top might signal a reversal.

Patterns like doji, hammer, and engulfing candles can signal shifts in market sentiment, offering clues about potential reversals or continuation of trends.

Indicators

Technical indicators are essential tools for many day traders, as they can help confirm market trends and momentum.

Examples of commonly used indicators:

- Moving Averages

Moving averages can help identify trends by smoothing price data. Traders often use the exponential moving average (EMA) for faster response to price changes. - Relative Strength Index (RSI)

Measures whether a currency pair is overbought or oversold, aiding in timing entries and exits. - Bollinger Bands

They show volatility and potential reversal zones by indicating how far prices deviate from their average. - Fibonacci Retracement

Highlights potential support and resistance levels, often used in trend-following strategies.

Fundamental Analysis

While technical analysis focuses on price movements, fundamental analysis examines the underlying factors that drive price movements. In the case of forex, we look for factors known to impact how one currency is valued in relation to another. In forex trading, these factors often include macroeconomic data, geopolitical events, and central bank policies. When new, heavy information is released, markets can get extra stormy.

Economic data releases can have a significant impact on currency prices. Traders doing fundamental analysis will therefore monitor economic indicators such as:

- Interest Rates

Central banks like the U.S. Federal Reserve or European Central Bank adjust interest rates to control inflation and economic growth. Higher rates often strengthen a currency as they attract foreign investment. - Employment Reports

Data such as the U.S. Nonfarm Payrolls report provides insight into the health of an economy, influencing market sentiment and currency values. - Inflation Figures

Metrics like the Consumer Price Index (CPI) reveal inflation trends, which are closely tied to monetary policy decisions.

Geopolitical Events

Political developments, elections, trade agreements, and major conflicts are all examples of factors that can create volatility in forex markets. For example, Brexit negotiations significantly impacted the GBP/USD pair due to uncertainty surrounding the UK’s economic future.

Central Bank Policies

Central banks play a crucial role in shaping currency values through monetary policy. Announcements about interest rate changes, quantitative easing, or economic outlooks often lead to sharp market movements.

Market Sentiment

Fundamental analysis also considers market sentiment, which reflects traders’ collective attitudes toward a currency. Events like natural disasters or unexpected political developments can sway sentiment, even if underlying economic indicators remain strong.

Combining Technical and Fundamental Analysis

While some traders favour one approach over the other, combining technical and fundamental analysis often yields the best results. For example, a trader might use fundamental analysis to identify a currency pair likely to experience volatility due to an upcoming central bank decision, then use technical analysis to determine the optimal entry and exit points.

Integrating both methods allows traders to align their strategies with the bigger picture while making precise, data-driven decisions. You can for instance use fundamental analysis to focus on pairs influenced by economic events like the Nonfarm Payrolls report, and apply technical analysis to spot price levels or patterns that align with market sentiment.

To become a more well-rounded forex day trader, it can therefore be a good idea to dedicate time to understanding both technical and fundamental analysis. Technical analysis helps you react to short-term price movements, while fundamental analysis provides context for why those movements occur.

By balancing these two approaches, you can gain a comprehensive view of the forex market and position yourself to make informed and confident trading decisions.

Risk Management in Forex Day Trading

Effective risk management is essential to become a long-term profitable forex day trader. You need to protect your capital and limit losses while pursuing potential profits. Without a clear risk management strategy, even a few bad trades can lead to significant financial setbacks and make it difficult for a trader to recover and keep their momentum.

You need to have risk management routines in place that will protect your trading capital. No matter how skilled you become, losses are an inevitable part of day trading. Thinking that you will someone device a trading plan where there are no losses is a dangerous thing, as it can make you neglect risk management. You need to accept that even with a great trading plan, there will be losing trades, and risk management is about minimizing the impact of individual losing trades.

By implementing a disciplined approach to risk management, you can decrease the impact of losses and ensure your ability to keep trading and improving. Approach each trade in accordance with your trading plan, stick to your risk limits, and focus on consistency rather than quick big wins. By prioritizing risk management, you set the stage for long-term success in the forex market.

Below, we will take a look at a few important principles and techniques that can help you managing risk in forex day trading and improve your chances of achieving long-term sustainability and success.

Setting a Per-Trade Risk Limit

One important aspect of managing risk is determining how much of your trading capital you are willing to risk on any single trade. A common rule is to limit this amount to 1%–2% of your total account balance. For example, if your account is $10,000, you should not risk more than $100–$200 on a single trade.

This conservative approach ensures that a string of losing trades won’t deplete your account and allows you to stay in the game while refining your strategies.

Calculating Position Sizes

This point ties into the setting of a per-trade risk limit, as you will need to calculate position sizes to fully implement that rule.

To calculate position size, consider:

- The percentage of capital you are willing to risk.

- The distance between your entry price and stop-loss level.

For example, if you’re risking 1% of a $10,000 account ($100) and your stop-loss is 20 pips away, your position size should be small enough so that a 20-pip loss equals $100. Calculators available on most trading platforms can simplify this process.

Setting a Total Risk Limit

Even if you stick to the rule of thumb and never risk more than 2% of your total account balance on a single trade, you can still be in hot water if a sudden event causes turmoil on the forex market when you have most of your capital in open positions.

Example: If you have $10,000 in trading capital and is risking $200 each on 50 open positions right now, you have your entire trading capital, $10,000, at risk.

Even with stop-loss orders in place, liquidity issues and slippage can quickly erode your capital during an unusually turbulent trading session.

Because of this, it is a good idea to also set a limit for how much of your trading capital you allow yourself to risk in combined trades at any given time.

Using Stop-Loss Orders

The stop-loss order is a critical tool for managing risk in forex trading. It automatically creates an immediate sell order for an open position when the price reaches a predetermined level. Provided that there is enough liquidity in the market, the position will be closed immediately, preventing further loss.

Example:

- You open a position of 100 units when the price is $100, for a total of $10,000. You set the stop loss at $95. If the price drops to $95, your 100 units will be sold, for a total of $9,500. You have limited your loss to $500.

Some brokers and trading platform also permits trailing stop-loss orders. Instead of setting a specific price point as the stop-loss point, you arrange for the asset to be sold if the price drops by more than certain percentage, or by more than a certain amount of money, from the current market price. A trailing stop-loss will therefore move up as the price moves up.

Examples of benefits of using stop-loss orders:

- Setting stop-loss orders ensures that emotions don’t lead you to hold onto losing positions longer than necessary.

- With stop-loss and take-profit orders in place, you can stop worrying about the position and use your time and energy more productively, e.g. to look for other high-quality trading opportunities.

For day traders, stop-loss levels are normally based on technical analysis, such as key support and resistance levels or the average true range (ATR). Ensure your stop-loss distance aligns with your trading strategy and the volatility of the currency pair you’re trading.

Maintaining a Favourable Risk-to-Reward Ratio

A favourable risk-to-reward ratio ensures that potential profits outweigh potential losses. Many traders aim for a minimum ratio of 1:2, meaning you stand to gain $2 for every $1 you risk.

For example, if your stop-loss is set at 10 pips below your entry price, your profit target should be at least 20 pips above your entry price. By consistently trading with a favourable risk-to-reward ratio, you can offset losses with fewer winning trades.

Resist the temptation of entering into trades that you believe will be profitable but where the risk-to-reward ratio is not good enough. This will require some emotional discipline, and it can be especially difficult when you are a beginner, or when you find yourself in a situation where spotting more suitable trading opportunities has proven to be difficult.

Diversifying Trades

Diversification reduces risk by spreading your capital across different trades and currency pairs. Avoid putting all your funds into a single trade or relying too heavily on one currency pair.

For example, if you’re trading EUR/USD, consider diversifying into other pairs like GBP/USD or USD/JPY to reduce exposure to a single market movement.

The other side of this coin is that for each currency pair that you wish to trade, you will need to make sure you have the proper education and information, you will need to carry out the appropriate analysis for that specific pair, and so on. Adding an additional currency pair to the mix is not easy – at least not if you want to endeavour to be long-term profitable.

Unfortunately, many forex traders – especially beginners – spread themselves way too thin and trade currency pairs they do not know enough about, believing they are doing something good because they have been told that diversification is important.

While diversification is important, it should not be carried out on a whim. You will need to put in time and effort to get to a point where you can confidently predict the market movements of more than one currency pair.

Monitoring News and Volatility

Economic events and geopolitical developments can lead to sudden price swings in the forex market. While these events create opportunities, they also carry heightened risk.

Stay informed by using a high-quality economic calendar to track upcoming announcements, such as central bank meetings or employment data releases. Adjust your risk parameters or consider sitting out during high-volatility periods if you’re uncertain about market direction.

Having a Plan in Place to Not Over-Leverage

Leverage is a double-edged sword in forex trading. While it allows traders to control larger positions with less capital, it will amplify both profits and amplifies losses. Beginners often fall into the trap of using excessive leverage, which can quickly wipe out an account.

To avoid over-leveraging, use leverage conservatively and trade with manageable position sizes.

Do not use any leverage until you know exactly how it works and how you should adjust your risk management routines to take leverage into consideration.

It is good to have a plan in place regarding your use of leverage, to avoid being swept away by emotions in the heat of the moment. Simply thinking “I will always use leverage responsibly” is not enough.

If your account has Negative Balance Protection, make sure you know exactly what this means for your leveraged positions. Negative Account Balance Protection will protect your account from becoming negative (“in the red”), but it will typically also give the broker a right (or even a legal obligation) to automatically close one or more of your leveraged positions if the market moves too much against you. You can therefore find yourself in a situation where your leveraged positions are closed by your broker even though you would have preferred to keep them open and ride out a short-lived market price turmoil. In many countries, brokers are legally required to give retail traders (non-professional traders) Negative Account Balance Protection.

Having a Plan in Place to Avoid Over-Trading

Over-trading is when traders take too many positions in a short time, a behaviour which increases exposure to risk and transaction costs while reducing decision-making quality.

There is no objective rule available that will tell you how many positions that would be considered over-trading, since this depends on so many factors. A skilled, experienced and well-rested scalper may be able to properly handle a myriad of positions – in accordance with their trading plan – while another trader would struggle with a much smaller load.

A notable feature that we often see in cases of over-trading is that the trader broke their trading plan and the risk management routines (or had no or low-quality rules in place), and that the decisions to open up more and more positions were impulsive and driven by sudden emotions in the heat of the moment. Greed, boredom, and revenge trading are all common factors in over-trading.

As a part of your overall trading plan, you should set a daily limit on the number of trades and/or the total amount of capital (percentage of your bankroll) you’re willing to risk during a trading session.

Forcing yourself to stick to these self-imposed limits will not only help protect your from the pitfalls of over-trading, it will also force you to seek out the most high-quality trade opportunities, as you know that your number of trades in each session are limited. That is a good habit to build early in your trading career.

As you grow more experienced, you can always adjust your limits to account for your increased abilities. Adjustments should only be carried out when you are calm and collected – never in the heat of the moment.

Note: Some days, you will simply be less fit for trading. This is a part of life and something you must learn to recognize. If your capacity is temporarily decreased – e.g. because you did not get enough sleep last night – you may need to temporarily lower your limits accordingly. Also pay special attention to your thoughts and actions. If you feel inclined to trade impulsively and make decisions based on emotion rather than strategy, step away and get some rest. Developing this level of self-awareness and discipline can take time but is well worth it.

Regularly Reviewing Performance

Keeping a trading journal is essential for improving your risk management skills. Record each trade, including entry and exit points, position size, stop-loss level, and the outcome. Analyse your journal regularly to identify patterns, assess your adherence to risk management rules, and refine your strategy. Reviewing your performance helps you understand where you’re succeeding and where you need to make adjustments, ensuring continuous improvement.

Some trading platforms comes with supportive tools for this, to make it easier for traders to carry out this part of the job.

Psychological Aspects of Forex Day Trading

As we have touched on earlier in this article, the psychological demands of forex day trading are just as critical as technical skills or market knowledge. Even with a solid strategy, emotional and mental challenges can undermine a trader’s performance. Learning to manage these psychological aspects is essential for maintaining discipline, consistency, and long-term success in the fast-paced and often stressful world of day trading.

Managing Emotions in Trading

Emotions such as fear and greed are natural reactions to trading outcomes, but can significantly impact decision-making if not controlled. For example, fear may cause traders to exit a profitable position too early, while greed can lead to over-trading and taking excessive risks.

To manage emotions effectively, it’s essential to approach trading with a clear and objective mindset. Developing and sticking to a well-defined trading plan helps reduce emotional decision-making by providing structure and predetermined rules for entering and exiting trades.

When experiencing emotional reactions, take a step back and reassess. Pausing to regain composure can prevent impulsive actions that deviate from your strategy.

Building Emotional Discipline

Emotional discipline includes the ability to remain calm and focused regardless of market conditions. This skill is vital in forex day trading, where rapid price movements can trigger stress or impulsivity in traders.

One way to help boost discipline is by setting realistic expectations. Understanding that losses are a normal part of trading helps reduce frustration and keeps you focused on long-term consistency. Additionally, practising mindfulness techniques, such as deep breathing or meditation, can improve your ability to stay present and focused during volatile trading sessions.

A critical aspect of discipline is knowing when to walk away. If you’re feeling overwhelmed or emotionally charged, it’s often better to step back and return to the market with a clear head. This can be especially difficult to learn for traders who have been raised with a type of mindset that puts a premium on continuing to work regardless of the circumstances. For them, stepping away from the screen is equal to being weak, a quitter, etcetera and they should just push through and continue with the task at hand. It is very important to realise that day trading is not one of those jobs where this is a good idea. Knowing when not to trade – and having the discipline to step away – is a key element to being a long-term successful day trader. There will be many times during your day trading career when you will need to refrain from opening positions; e.g. because you are not in a good condition to trade or because the market is not presenting your with good enough opportunities that align with your trading plan.

Handling Stress and Pressure

Forex day trading is inherently stressful, especially during periods of high volatility or after experiencing losses. Prolonged stress can cloud judgment and lead to burnout, making it essential to develop strategies for managing pressure effectively. Simply repeating the mantra “No worries, I´m good at handling stress” will not be enough.

Start by maintaining a balanced routine in your life – one that extends far beyond the trading sessions. Adequate sleep, appropriate exercise, and healthy eating habits contribute to better focus and resilience. Incorporating mandatory breaks into your trading schedule also helps you stay refreshed and avoid mental fatigue. During your breaks, make sure you get physical movement and screen-free time.

Creating a positive trading environment can further reduce stress. A clutter-free workspace with reliable tools and minimal distractions allows you to concentrate fully on the market. Make sure the set-up is ergonomically sound and suitable for your needs and preferences.

Have A Plan for How To Avoid Revenge Trading

Revenge trading is a common psychological pitfall where traders try to recover losses by deviation from the trading plan and making impulsive or high-risk trades. This behaviour often leads to even greater losses and perpetuates a cycle of frustration. In many ways, it is similar to when a gambler in a casino is making increasingly large and risky bets in an effort to win back lost money.

Here are a few examples of points that can help you avoid revenge trading:

- Be aware of what revenge trading is and the psychological mechanisms behind it. Do not think that you are immune to it.

- Accept that losses are an inevitable part of day trading, and focus on the bigger picture. Make sure your trading plan and risk management routines reflect this.

- Be aware of which situations that are extra likely to trigger revenge trading impulses. With some journaling and self-reflection, you may be able to identify which situations that are especially risky for you. Is it one big loss, or a series of losses? Maybe when the market reacts to unexpected news? Or when your emotions are raw because of something else that is going on in your life?

- Taking a break after a scathing loss or losing streak allows you to regain perspective and return to the market with a clear and rational mindset.

- Do not risk money you can not afford to lose. A trader losing money that is needed for rent and food is likely to engage in revenge trading out of desperation. As you build your day trading skills, the money in your trading account should be earmarked for trading, and you should not put money in that account that you will need for paying bills or handle other financial responsibilities.

The Importance of Confidence

Confidence is essential for executing trades decisively and adhering to your strategy. However, confidence should be based on preparation and practice, not arrogance or the Dunning–Kruger effect.

Building confidence begins with mastering the basics of trading and gaining experience through practice, such as using a demo account. Over time, tracking your performance and analysing your successes and failures will reinforce what works and help you refine your approach.

It is important to avoid becoming overconfident after a series of successful trades. Overconfidence can lead to riskier behaviour, such as increasing position sizes or ignoring risk management rules. Stay grounded and consistent, regardless of recent outcomes. Some traders become so happy after a series of successful trades that they make themselves believe they are exceptionally skilled, that they have found a way to perfectly read the market, that they should throw caution to the wind because their gut feeling will never be wrong from now on, etcetera. This is a quick way to deplete a trading account. Many beginners fall into this trap at least once and are forced to slowly rebuild their bankroll again.

The Role of a Trading Plan

In this article, we keep harping on about your trading plan – because it is such a powerful weapon in the hands of the day trader. A trading plan will help you to better managing the psychological challenges of forex day trading, as it provides a framework for making decisions based on logic and pre-determination rather than impulsive emotions.

By defining factors such as your entry and exit criteria, risk tolerance, and profit goals in advance, a trading plan reduces uncertainty and helps you stay disciplined. When emotions run high, referring back to your plan can keep you grounded and focused on your long-term strategy.

Keeping a Trading Journal

Maintaining a trading journal is another effective way to address psychological challenges. Recording your trades, including the rationale behind them and your emotional state at the time, helps you identify patterns in your behaviour and decision-making. You may for instance notice how, for you, impulsive trades often occur after a series of losses, or you may spot that you have a tendency to exit winning trades too early due to fear instead of trusting your trading plan. Recognizing these tendencies allows you to develop strategies for overcoming them.

Fostering a Growth Mindset

Adopting a growth mindset is crucial for navigating the ups and downs of forex day trading. Instead of viewing losses as failures, see them as opportunities to learn and improve. Analyse what went wrong, adjust your approach if you deem it suitable, and apply those lessons moving forward.

A growth mindset also emphasizes the importance of continuous learning. Staying curious and open to new strategies or techniques keeps you adaptable in a constantly changing market environment.

The Path to Psychological Mastery

Mastering the psychological aspects of forex day trading requires self-awareness, discipline, and a commitment to personal growth. By managing emotions well, building confidence, and developing suitable strategies for handling stress, you can maintain the focus and resilience needed to succeed.

Trading is not just about executing strategies—it’s about cultivating the mindset to make thoughtful, consistent decisions in any market condition. With time, practice, and perseverance, you can overcome psychological challenges and thrive as a forex day trader.

Common Mistakes in Forex Day Trading

Forex day trading can be lucrative, but it’s also a challenging endeavour, particularly for those who are new to the fast-paced world of currency markets. Mistakes are part of the learning process, but some errors can significantly hinder your progress if not addressed early. By being aware of common pitfalls, you can develop plans for how to avoid them.

Trading Without a Plan

Entering the market without a well-defined trading plan is a recipe for inconsistency and frustration. A lack of structure often leads to impulsive decisions, such as chasing trades or holding onto losing positions longer than necessary.

A trading plan is comprehensive and will include points such as your long-term and short-term goals, strategies, risk management rules, and criteria for entering and exiting trades. Following this plan helps you maintain discipline and focus, even during volatile market conditions.

Having Unrealistic Expectations

Many new traders enter the forex market with unrealistic expectations of quick and massive profits. This mindset often leads to excessive risk-taking and disappointment when results fall short.

Approach trading as a skill that takes time to master. Focus on gradual improvement and consistent growth rather than immediate results. By setting realistic goals, you’ll build a Sustainable path to long-term success.

Ignoring Risk Management

Failing to manage risk effectively is one of the quickest ways to lose money in forex day trading. Many traders neglect to set stop-loss orders, they engage in over-trading, and they risk too much of their account on a single trade.

Implementing strict risk management practices, such as limiting the amount you risk per trade to 1%–2% of your account, is essential. Using stop-loss orders and take-profit orders, and maintaining a favourable risk-to-reward ratio ensures that even a losing streak doesn’t wipe out your account.

Overtrading

Overtrading occurs when traders take too many positions in a short period, often driven by boredom, fear of missing out (greed), or a desire to recover losses quickly (revenge trading). This behaviour increases transaction costs, reduces decision-making quality, and exposes you to unnecessary risks.

Instead of focusing on quantity, prioritize quality by waiting for high-probability setups that align with your trading plan. Recognizing the difference between patience and inactivity is key to avoiding overtrading.

Overleveraging

As mentioned above, not understanding what leverage entails and using excessive leverage are very common mistakes among novice day traders.

While leverage allows you to control larger positions with a smaller amount of capital, it also magnifies losses. Many beginner traders overestimate their ability to manage leverage, leading to rapid depletion of their accounts.

To avoid this, use leverage conservatively and ensure your position sizes align with your overall risk tolerance. Always consider the downside of a trade and never risk more than you can afford to lose. Do not use any leverage until your understand exactly how it works with your particular broker and trading account, down to the nitty-gritty details.

Chasing Losses (Revenge Trading)

Revenge trading, or chasing losses, is a common emotional reaction to a bad trade. Traders who fall into this trap often abandon their strategy and take on excessive risks in an attempt to recover their losses quickly. This behaviour frequently leads to even greater losses.

As day traders, we need to accept that losses are an inevitable part of trading and risk-taking. Take a step back after a losing streak, review the situation, calm down, and refocus on your trading plan before returning to the trading screen. An important aspect of self-awareness is to know when you are actually ready to trade again, and when you need to take a longer break.

Neglecting Market News

Economic events and geopolitical developments significantly impact currency prices. Ignoring these factors can lead to unexpected losses, especially if you’re caught on the wrong side of a major news event.

Staying informed by using an economic calendar and monitoring market news helps you anticipate periods of heightened volatility and adjust your strategy accordingly.

Sometimes novice traders become so focused on learning technical analysis that they forget about the bigger picture. Boosting this problem are the many self-proclaimed trading gurus out there slinging various “amazing” trading techniques, based on 100% technical analysis, promising remarkably high returns in no time, for barely no effort and with no risk. If something sounds to good to be true, it probably is. You should also stop to consider why the person who has invented or stumbled upon a risk-free, low-effort money machine is so super eager to sell it to you for just a few $$$.

Building a Forex Day Trading Routine

A structured routine is essential for maintaining focus, discipline, and efficiency in forex day trading. By establishing habits that align with your trading goals, you can approach the market with a clear and consistent mindset.

Pre-Market Preparation

Start your trading day by preparing thoroughly. Review charts from the previous session to identify trends, support and resistance levels, and key price zones.

Check the economic calendar for any significant events or data releases that could impact the markets you plan to trade. You are probably up to date on a lot of this already, and maybe you even picked this specific date for trading certain assets because you know that very interesting trading opportunities are likely to emerge today.

During this preparation phase, you will also outline your trading plan for the day, including specific strategies, potential trade setups, risk management parameters, and pre-planned breaks from the screen. This helps you approach the market with clear objectives and reduces impulsive decision-making. You don´t have to build a new plan from scratch every time; you should already have an overarching trading plan in place, and in many ways your day-plan will simply reflect decisions made earlier for that plan.

Always make sure you start your pre-market preparation in time to get everything ready for the part of the day when you plan on engaging in active trading.

Executing Trades During Market Hours

During the trading session, focus on monitoring the markets and executing trades that align with your plan. Use technical analysis tools to confirm setups and ensure that each trade adheres to your risk and reward criteria.

Staying disciplined is crucial. Do not deviate from your trading plan due to market noise or emotional reactions.

Keep an eye out for signs of over-trading. Remember that taking fewer, high-quality trades is often more profitable than chasing every potential opportunity.

Taking Breaks

Trading can be mentally taxing, especially during periods of high volatility. Incorporate regular breaks into your routine to stay refreshed and focused. Step away from the screen for a few minutes, get some fresh air and move your body. This helps prevent fatigue and reduces the likelihood of emotional decision-making.

Post-Market Review

At the end of the trading session, take time to review your performance. Analyse each trade, noting what worked well and where improvements are needed. Record details such as entry and exit points, position sizes, and your emotional state during the trade.

This review process allows you to identify patterns in your behaviour and strategy, providing valuable insights for refining your approach. Continuous reflection and learning are key components of long-term success.

Staying Consistent

A well-structured routine fosters consistency and discipline, which are critical for navigating the complexities of forex day trading. By preparing thoroughly, sticking to your plan, and reviewing your performance regularly, you create a sustainable framework for growth and improvement. Day trading is a skill that develops over time, and building a solid routine is an investment in your future success.

Using Demo Accounts to Practice Forex Day Trading

A demo account is an invaluable tool for anyone learning to trade forex. These accounts allow you to trade in real-time market conditions using virtual money (free play-money), providing an environment where you can develop your skills, test strategies, and familiarize yourself with trading platforms without risking real money on trades.

For beginners and experienced traders alike, practising with a demo account is a crucial step toward mastering forex day trading and refining trading strategies.

Why Use a Demo Account?

Demo accounts simulate live trading conditions, offering an almost authentic experience without the financial risk.

Here are a few examples of reasons as to why demo account use is an important strategy for day traders:

- Learning Market Dynamics

With a demo account, novice day traders can observe how the forex market operates, including price fluctuations, volatility, and the influence of economic events. - Practising Platform Navigation and Use

Familiarity with your trading platform is essential for executing trades quickly and accurately. Demo accounts allow you to explore features like order types, charting tools, and indicators. - Find Out If It Is The Right Platform For You If you dislike a platform, or if it proves unsuitable for your trading strategy, it is good to find out before you have made any deposit. Therefore, it is wise to always test a new trading platform using a free demo account before you decide if you want to make your first deposit.

- Testing Strategies A demo account provides a safe environment to experiment with different trading strategies, such as scalping, trend-following, or breakout trading, without risking your capital. Using a demo account to test and refine strategies ensures they are effective before implementing them with real money. This process allows you to evaluate the strengths and weaknesses of different approaches under varying market conditions.

- Building Confidence

Trading with virtual money allows you to develop confidence in your skills and strategies before transitioning to a live account. - Learn From Your Mistakes

A demo account allows you to make mistakes without financial consequences. This freedom to learn through trial and error is invaluable for building a strong foundation in trading. - Find Out About Yourself While demo accounts can’t replicate the emotional stakes of live trading, they can still help you identify certain potential psychological challenges, such as overtrading or abandoning your strategy due to boredom and a lack of discipline. Recognizing such tendencies early can help you prepare for some of the emotional aspects of live trading.

Setting Up and Using a Demo Account

Most brokers and platforms offer demo accounts that use real-world trading data. Setting one up is usually straightforward, requiring only a few personal details (such as an email address) to create an account.

Once your demo account is active, approach it as if it were a live account:

- Set an initial virtual balance that reflects the amount of capital you would realistically trade with.

- Use the same risk management rules, such as limiting risk to 1%–2% of your account per trade.

- Practice executing trades based on a well-defined strategy.

Treating the demo account seriously ensures you develop habits and skills that translate effectively to live trading.

Limitations of Demo Accounts

While demo accounts are highly beneficial, they do have limitations that are important to stay away of.

One notable example is the lack of emotional pressure. Trading with virtual money doesn’t replicate the psychological impact of real financial risk. The confidence and emotional stability you have become familiar with while using your demo account may waver when transitioning to a live account and putting your own hard-earned cash on the line.

The absence of true risk in a demo account can lead to unrealistic trading behaviour, such as taking excessive risks or ignoring proper risk management. This can turn into bad habits that may be hard to shake as you transition to a real-money account.

Another short-coming with demo accounts is that many of them present ideal trading conditions where you never have to worry about slippage and liquidity issues affecting trade execution. If your demo account does not fully reflect these challenges, you need to keep this in mind as you transition to real-money trading. This type of perfect demo account trading conditions can seriously misrepresent the liquidity of minor and exotic currency pairs, making you develop strategies for them that turn out to be quite problematic in the real world. With this in mind, novice forex traders are typically recommended to start with the most liquid forex pairs; the so-called majors.

Transitioning to Live Trading

After gaining sufficient experience and confidence with a demo account, transitioning to live trading is the next step. Start small, using a modest amount of capital to minimize risk while adjusting to the realities of live markets.

Maintain the same discipline and strategies developed during your demo practice. Resist the temptation to deviate from your trading plan due to the emotional pressures of live trading.

Pros and Cons of Forex Day Trading

Forex day trading can be an exciting and potentially profitable venture, but it’s not without its challenges. Understanding the advantages and disadvantages of day trading in the forex market can help you make an informed decision about whether this trading style aligns with your goals, risk tolerance, and lifestyle.

Pros of Forex Day Trading

1. High Liquidity

The forex market is the most liquid financial market in the world, with the equivalent of trillions of dollars traded daily. This liquidity ensures that trades can be executed quickly and efficiently, even for large positions, making it easier for day traders to enter and exit positions without significant price fluctuations.

2. Accessibility

Forex trading is accessible to anyone with an internet connection, a suitable device (computer or smartphone) and a trading account with a forex broker. Many brokers offer low initial deposit requirements, demo accounts, and user-friendly platforms, allowing beginners to start trading with minimal barriers. This is not unique to forex trading – it is true for many different types of trading, including stock market speculation.

3. 24/5 Market

Unlike stock markets, the forex market operates 24 hours a day, five days a week. This continuous trading window allows day traders to find opportunities at any time, accommodating different schedules and time zones.

4. Leverage Opportunities

It is common for forex brokers to offer very high leverage, enabling traders to control larger positions with a smaller amount of capital.

While leverage amplifies profits, it also amplifies losses and creates new types of risk. In may parts of the world, the financial authorities are now limiting how much leverage a broker is permitted to give a retail trader (non-professional trader).

5. Opportunities in Both Rising and Falling Markets

Forex trading allows traders to profit from both bullish and bearish markets by taking long (buy) or short (sell) positions. This flexibility provides opportunities regardless of the overall market direction. Going in long and short is possible even on other markets too, e.g. the stock market, but it can be a bit more complicated. At the forex market, you are always buying one currency and paying with another (e.g. buying EUR and paying with USD) so you will simply buy the currency you think will appreciate against another currency, and pay with that other currency.

6. Volatility and Frequent OpportunitiesThe forex market’s inherent volatility creates frequent price movements, offering day traders ample opportunities to capitalize on short-term trends and patterns.

Cons of Forex Day Trading

1. High Risk

Forex day trading is inherently risky. Even a small market move against your position can result in significant losses if not managed carefully. Of course, risk is not unique to the forex market. With any type of trading, it is important to have a proper risk management plan in place and stick to it.

2. Emotional Stress

Any type of day trading (forex, cryptocurrency, stocks, etc) requires constant attention and quick decision-making, which can be emotionally taxing. Managing fear, greed, and frustration is a continuous challenge that can impact both trading performance and mental health.

3. Steep Learning Curve

Becoming proficient in forex day trading requires a solid understanding of market dynamics, technical analysis, and risk management. The learning process can be time-consuming and take a lot of effort. It is not advisable to rush into forex trading without adequate preparation.

4. Potential for OvertradingThe fast-paced nature of day trading can tempt traders to take too many positions, often leading to overtrading. This behaviour increases transaction costs and increases the risk of bad decision-making.

5. Dependence on Consistent Volatility

While volatility creates opportunities, periods of low market activity can limit trading opportunities and lead to frustration for day traders who thrive on frequent price movements. It is important to develop the required discipline to refrain from trading when you do not see any high-quality opportunities that matches your trading plan.

6. Transaction Costs

Frequent trades can lead to high transaction costs, including spreads and commissions. These costs can quickly add up, eating into profits, especially for traders with small accounts.

7. Requires Time and FocusDay trading demands full attention during market hours. For those with other commitments, balancing the time requirements of day trading with personal and professional responsibilities can be challenging.

Weighing the Pros and Cons

Forex day trading offers numerous benefits, including high liquidity, accessibility, and the potential for significant profits. However, it also comes with notable risks and challenges, such as emotional stress, the need for constant focus, and the potential for substantial losses.

Before committing to day trading, consider whether you have the time, resources, and temperament to handle its demands. If approached responsibly and with adequate preparation, forex day trading can be a rewarding pursuit, but it’s not suitable for everyone. Understanding both the advantages and drawbacks will help you make an informed decision about whether this trading style aligns with your financial goals and lifestyle.

This article was last updated on: June 22, 2025